bitcoinexchanges.site Market

Market

Ftt Coinbase

Easily convert FarmaTrust to Silver (Troy Ounce) with our cryptocurrency converter. 1 FTT is currently worth XAGNaN. How do I add an FTT (FTX) account and have my tokens display up in my balance? Coinbase holding my crypto hostage. upvotes · comments. Get the latest price, news, live charts, and market trends about FTT Token. The current price of FTT Token in Singapore is S$ per (FTT / SGD). Connect your Binance, MetaMask, Trust Wallet, Coinbase & others. cryptocurrencies, it doesn't allow US citizens to trade in FTT tokens. For. We would expect to see a large number of bitcoin holders trying to dump their holdings on actual-dollar exchanges like Coinbase in a mad rush to get out of the. FTT to Turkish Lira conversion tables. The exchange rate of FarmaTrust is decreasing. The current value of 1 FTT is TRY TRY. In other words, to buy 5. Get the latest price, news, live charts, and market trends about FTT Token. The current price of FTT Token in United Kingdom is £ per (FTT / GBP). The price of FTX Token (FTT) is $ today, as of Aug 30 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. The live FTX Token price today is $ USD with a hour trading volume of $8,, USD. We update our FTT to USD price in real-time. FTX Token is up %. Easily convert FarmaTrust to Silver (Troy Ounce) with our cryptocurrency converter. 1 FTT is currently worth XAGNaN. How do I add an FTT (FTX) account and have my tokens display up in my balance? Coinbase holding my crypto hostage. upvotes · comments. Get the latest price, news, live charts, and market trends about FTT Token. The current price of FTT Token in Singapore is S$ per (FTT / SGD). Connect your Binance, MetaMask, Trust Wallet, Coinbase & others. cryptocurrencies, it doesn't allow US citizens to trade in FTT tokens. For. We would expect to see a large number of bitcoin holders trying to dump their holdings on actual-dollar exchanges like Coinbase in a mad rush to get out of the. FTT to Turkish Lira conversion tables. The exchange rate of FarmaTrust is decreasing. The current value of 1 FTT is TRY TRY. In other words, to buy 5. Get the latest price, news, live charts, and market trends about FTT Token. The current price of FTT Token in United Kingdom is £ per (FTT / GBP). The price of FTX Token (FTT) is $ today, as of Aug 30 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. The live FTX Token price today is $ USD with a hour trading volume of $8,, USD. We update our FTT to USD price in real-time. FTX Token is up %.

Coinbase CEO Brian Armstrong aimed to ease jitters triggered by news that FTX would sell its non-U.S. assets to Binance amid a liquidity crunch by saying. Download Coinbase Wallet to buy and sell FarmaTrust on the most secure crypto exchange. Trade FarmaTrust. FarmaTrust is falling this week. The. FTT Overview All Markets FTT Price History Social Signals. FTX Token logo Coinbase · OKX Exchange. OKX · Bybit Exchange. Bybit · Upbit Exchange. Upbit. Buy. Julie is joined by Sanchan S. Saxena, VP of Products @ Coinbase For daily updates on the fintech space sent right to your email, subscribe to the FTT. Get the latest price, news, live charts, and market trends about FTT Token. The current price of FTT Token in France is € per (FTT / EUR). - The live price of FTT is $ with a market cap of $M USD. Discover current price, trading volume, historical data, FTT news. 【FTT ➦ USD Converter】➤➤➤ 1 FTT Token to US Dollar price calculator ✓ convert cryptocurrency online ✓ today exchange rates on ⏩ bitcoinexchanges.site Learn what FTX (FTT) cryptocurrency is and today's market price. Confidently invest in cryptocurrency with current and historical FTX market data. 2/ Second, Coinbase doesn't have any material exposure to FTX or FTT (and no exposure to Alameda). FTT/CHF: Convert FarmaTrust (FTT) to Swiss Franc (CHF). 1 FarmaTrust equals CHF Swiss Franc.. FarmaTrust (FTT) is not tradable on Coinbase. Data is. The price of FTX (FTT) is $ today with a hour trading volume of $9,, This represents a % price increase in the last Additionally, in the last day, ₩0 worth of FTT has been traded. Buy FarmaTrust with Coinbase Wallet. Create a Coinbase account to buy and sell FarmaTrust on the. FTX Token (FTT) is the native cryptocurrency of the FTX derivatives and spot cryptocurrency exchange. It serves as a utility token, offering benefits such. Beat the market, cryptocurrency trading sites on Indodax and trade FTT like a professional trader. No coding required. The live price of FTX Token is $ per (FTT / USD) with a current market cap of $ M USD. hour trading volume is $ M USD. FTT to USD price is. Download Coinbase Wallet to buy and sell FarmaTrust on the most secure crypto exchange. Trade FarmaTrust. FarmaTrust is falling this week. The. Coinbase, and Kraken. FTX was founded by Sam Bankman-Fried (otherwise known FTT rather than an independent asset like USD or bitcoin. It would have. Coinbase Wallet pairs perfectly with Koinly to make crypto tax easy! Sync Coinbase Does Coinbase Wallet provide financial or end of year statements? No. The current real time FTX Token price is $, and its trading volume is $6,, in the last 24 hours. FTT price has plummeted by % in the last day, and. 3X Long FTT Token (FTT3L), 3X Long FTT Token (FTT3L). FTT3Lgoes. above, below Real-time price monitoring across 48 exchanges, including Coinbase, Binance.

Best Trading Platform Review

Since each trading platform is different, it's important to read reviews and match up your needs with the broker's offering. Thinkorswim at TD Ameritrade is. Best rated. All brokers. All brokers. All brokers. Stocks Crypto Forex Futures Trading Platform · Brokerage integration · Partner program · Education program. ICE Trading Platform It is all in one trading platform for any asset class that you want to trade. The UI is very user friendly and easy to learn and operate. We have checked out over platforms to bring you the best trading platforms that suit your needs in the UK so you can focus on watching your money grow. Day Trading Platforms Compared & Reviewed · Best day trading platform for forex - IG · Best day trading platform with lowest fees - Fidelity · Best day trading. Categories · Interactive Brokers is out of best companies in the category Financial Institution on Trustpilot · Interactive Brokers is 52 out of 54 best. Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. My Top Picks for the Best Options Trading Platforms · TD Ameritrade · Robinhood · Ally Invest · E-Trade · TradeStation · Interactive Brokers · Webull. Interactive Brokers: Best Overall Trading Platform Interactive Brokers won “best trading platform” in our awards as they offer an exceptionally advanced. Since each trading platform is different, it's important to read reviews and match up your needs with the broker's offering. Thinkorswim at TD Ameritrade is. Best rated. All brokers. All brokers. All brokers. Stocks Crypto Forex Futures Trading Platform · Brokerage integration · Partner program · Education program. ICE Trading Platform It is all in one trading platform for any asset class that you want to trade. The UI is very user friendly and easy to learn and operate. We have checked out over platforms to bring you the best trading platforms that suit your needs in the UK so you can focus on watching your money grow. Day Trading Platforms Compared & Reviewed · Best day trading platform for forex - IG · Best day trading platform with lowest fees - Fidelity · Best day trading. Categories · Interactive Brokers is out of best companies in the category Financial Institution on Trustpilot · Interactive Brokers is 52 out of 54 best. Finally, moomoo holds the best international trading platform award for Chinese stocks. International investors will find each global trading platform opens the. My Top Picks for the Best Options Trading Platforms · TD Ameritrade · Robinhood · Ally Invest · E-Trade · TradeStation · Interactive Brokers · Webull. Interactive Brokers: Best Overall Trading Platform Interactive Brokers won “best trading platform” in our awards as they offer an exceptionally advanced.

If you are looking to actively trade the markets, you will want to pay more attention to your broker's trading platform. Unlike buy-and-hold investors who. The Interactive Brokers trading platform is top-notch and could make you feel like you're in a fast-paced movie about the stock market. It supports a huge. The XTB platform combines all the features of a professional trading platform, which was also built with beginners in mind. My Top Picks for the Best Options Trading Platforms · TD Ameritrade · Robinhood · Ally Invest · E-Trade · TradeStation · Interactive Brokers · Webull. It provides educational content and a paper trading feature for beginners to practice trading strategies. Read our full review of TD Ameritrade. Fidelity. Why. The best trading platform I do personal forex trading and I am also teaching others to trade forex, they too appreciate the app. It is easy to access. How many stars would you give Trading Platforms? Join the 7 people who've already contributed. Your experience matters. Interactive Brokers is Australia's best – and most comprehensive – trading platform. Rock-bottom brokerage fees mean you get to keep more of your money. The. Read in-depth reviews of more than global online brokers to find the best one for you. Covers fees, trading platforms, investor protection and much. Discount brokers are a user-friendly and cost-effective platform where the brokerage service mainly focuses on basic trading. They are primarily for simple. Best for Active Traders: LightSpeed Trading · Eze EMS (the former RealTick Pro): This one is designed for futures traders. · Livevol X: This platform offers. Read in-depth reviews of more than global online brokers to find the best one for you. Covers fees, trading platforms, investor protection and much. Interactive Brokers Is Best For: · Sophisticated individual and professional investors, as well as buy-and-hold investors on IBKR Lite · Investors looking to. Interactive Brokers is the best online broker in - Extremely low fees. Wide range of products. Many great research tools. eToro - Free stock and ETF. Its app and website provide a high level of technical analysis, along with automated trading tools including trailing stops and limit orders. The IG Academy. Lightspeed Trading is one of the premier brokers when it comes to day trading. We really liked their platform and commission schedule but if you aren't an. This guide will help you discover your perfect trading app. We'll review and compare them based on the factors that are most important to traders. Interactive. Interactive Brokers Tops Barron's Ranking of Best Online Brokers The 24th annual study puts Fidelity second, and, in a surprise, E*Trade jumps up to grab. Fidelity is another trusted name in banking and investing, and their stock trading platform reflects their prestige. The Fidelity app provides a.

How Much Extra To Pay Off Mortgage In 15 Years

By paying more than your required monthly mortgage payment, you can put that extra money directly toward the principal amount on your loan. Your interest. How advantageous are extra payments? · Making extra payments may save you $37, in interest · How Do I Pay Off My Mortgage Early? payment is $1,, you would need to pay an additional $ onto your principal amount to pay your loan off in 15 years. So instead, you could spread that extra. To pay off your house faster with this option, split your monthly mortgage payment amount in half and send it every two weeks. By the end of the year, you'll. The APR is normally higher than the simple interest rate. Original mortgage term. Total length, or term, of your original mortgage in years. Common terms are This Mortgage Payoff Calculator will help you determine how much faster you can pay off your mortgage by increasing your monthly mortgage payments. A common strategy is to divide your monthly payment by 12 and make a separate “principal-only” payment at the end of every month. Be sure to label the. Find a mortgage payment calculator on line (there are dozens of them), enter the mortgage balance, the interest rate and 15 years as the term. This early payoff calculator will also show you how much you can save in interest by making larger mortgage payments. By paying more than your required monthly mortgage payment, you can put that extra money directly toward the principal amount on your loan. Your interest. How advantageous are extra payments? · Making extra payments may save you $37, in interest · How Do I Pay Off My Mortgage Early? payment is $1,, you would need to pay an additional $ onto your principal amount to pay your loan off in 15 years. So instead, you could spread that extra. To pay off your house faster with this option, split your monthly mortgage payment amount in half and send it every two weeks. By the end of the year, you'll. The APR is normally higher than the simple interest rate. Original mortgage term. Total length, or term, of your original mortgage in years. Common terms are This Mortgage Payoff Calculator will help you determine how much faster you can pay off your mortgage by increasing your monthly mortgage payments. A common strategy is to divide your monthly payment by 12 and make a separate “principal-only” payment at the end of every month. Be sure to label the. Find a mortgage payment calculator on line (there are dozens of them), enter the mortgage balance, the interest rate and 15 years as the term. This early payoff calculator will also show you how much you can save in interest by making larger mortgage payments.

This mortgage payoff calculator makes figuring out your required extra payment easy. You choose how quickly you'd like to pay off your mortgage. Make extra payments · Paying extra each month. When making your payments, add extra money to pay down your balance a little bit at a time. · Making lump sum. By rounding up your monthly principal and interest payment or by considering biweekly payments rather than monthly, you may be able to save on the amount of. Increasing payments towards the principal can save you a huge amount of money in interest over the years. Overpaying your mortgage significantly reduces the. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. By the end of each year, you will have paid the equivalent of 13 monthly payments instead of This simple technique can shave years off your mortgage and. Using mortgage calculator, a 15 year mortgage at % costs roughly $k in interest. % is roughly $k. That's a difference of $30k, or. The following early mortgage payoff calculator provides the new monthly payment required to reduce the amortization period of your mortgage loan. Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator. The following calculator makes it easy for homeowners to see how quickly they will pay off their house by making additional monthly payments on their loan. How much interest can be saved by increasing your mortgage payment? This bitcoinexchanges.site mortgage payoff calculator helps you find out. Making extra payments of $/month could save you $60, in interest over the life of the loan. You could own your house 13 years sooner than under your. Use this mortgage payoff calculator to see how that works. Fill in "Additional principal payment" with an extra amount you could pay toward your mortgage each. This Mortgage Payoff Calculator estimates how paying extra each month, or biweekly, can accelerate the time to pay off your loan and how much interest you can. The most budget-friendly way to do this is to pay 1/12 extra each month. For example, by paying $ each month on a $ mortgage payment, you'll have paid the. The APR is normally higher than the simple interest rate. Original mortgage term. Total length, or term, of your original mortgage in years. Common terms are By the end of each year, you will have paid the equivalent of 13 monthly payments instead of This simple technique can shave years off your mortgage and. The most common lengths are 15 years and 30 years. Years Remaining: Total How to save on interest by paying off your home loan early. When you take. Compared to a year term, paying extra gives you the freedom to decide how much you can add to your mortgage payments. This can be as small as $50 a month.

How To Climb Out Of Credit Card Debt

Paying off credit card debt. What are my options? Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. We're here to help with some tips about how to pay off credit card debts. Limit credit card use. If you have only one card, try to limit your use. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. Related content. 4 strategies to pay off credit card debt faster. Read more, 2 Climbing out of debt can feel overwhelming and costly. That's why it's. Following these credit card payoff tips can help you effectively chip away at balances and finally become debt-free. Paying off credit card debt can feel daunting. But with some research, an effective plan and consistency, you can get one step closer to paying off debt. Add Up All Your Debt; Adjust Your Budget; Use a Debt Repayment Strategy; Look for Additional Income; Consider Credit Counseling; Consider Consolidating Your. How to Attack Credit Card Debt · Pay More than the Minimum · Pay Off the Highest Interest Rate First · Avoid New Debts · Transfer Your Balances · Consolidate Your. Paying off credit card debt. What are my options? Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. We're here to help with some tips about how to pay off credit card debts. Limit credit card use. If you have only one card, try to limit your use. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. Related content. 4 strategies to pay off credit card debt faster. Read more, 2 Climbing out of debt can feel overwhelming and costly. That's why it's. Following these credit card payoff tips can help you effectively chip away at balances and finally become debt-free. Paying off credit card debt can feel daunting. But with some research, an effective plan and consistency, you can get one step closer to paying off debt. Add Up All Your Debt; Adjust Your Budget; Use a Debt Repayment Strategy; Look for Additional Income; Consider Credit Counseling; Consider Consolidating Your. How to Attack Credit Card Debt · Pay More than the Minimum · Pay Off the Highest Interest Rate First · Avoid New Debts · Transfer Your Balances · Consolidate Your.

Ways to Pay Off Credit Card Debt. What to Know. Credit cards are a convenient way to make both large and small purchases. They can also lead to a significant. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. There are many effective methods for paying down debt. For example, the debt snowball and avalanche methods are two time-tested strategies. Credit card debt is easy to accrue and sometimes much harder to get rid of. But with some planning and focus, you can pay it down and become credit card-debt-. Be persistent and polite. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work. Step 1: Make all your minimum payments · Step 2: Build up a cash buffer · Step 3: Capture the full employer match · Step 4: Pay off any credit card debt · Step 5. You should focus on paying off credit cards with a high interest rate first. The longer you hold on to high-interest debt, the more interest you rack up. One surefire way to keep yourself stuck with credit card balances? Only making minimum payments. Roughly half to two-thirds of every payment you make is. Stop the flood of credit card offers by calling OPTOUT or visit bitcoinexchanges.site Residents can stop the unsolicited mail for five years or. How a year-old paid off $16, in credit card debt in less than a year (and hasn't paid a cent in interest since) · Step 1: She calculated her budget · Step. 1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off. Eliminating credit card debt depends on three things: spending habits, saving habits and determination. That last one will make the following steps more. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit. When you owe money on your credit card, the people you owe must follow rules set out by law. Action can be taken against you to collect the debt but you have. Here are 10 practical ways you can quickly tackle your maxed out cards and take your first real steps towards getting out of debt. How to get rid of your credit card debt · 1. If you're in a bind, talk to your credit card issuer · 2. Identify the cause of your credit card debt · 3. Choose a. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will. A debt consolidation loan — like a personal loan or home equity loan — might simplify your debt payoff plan and save you money on interest. The best way to pay down credit cards is to start with the lowest balance and work your way up. However, there are other tactics you can take as well. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will.

How Much Do Retaining Walls Cost Per Square Foot

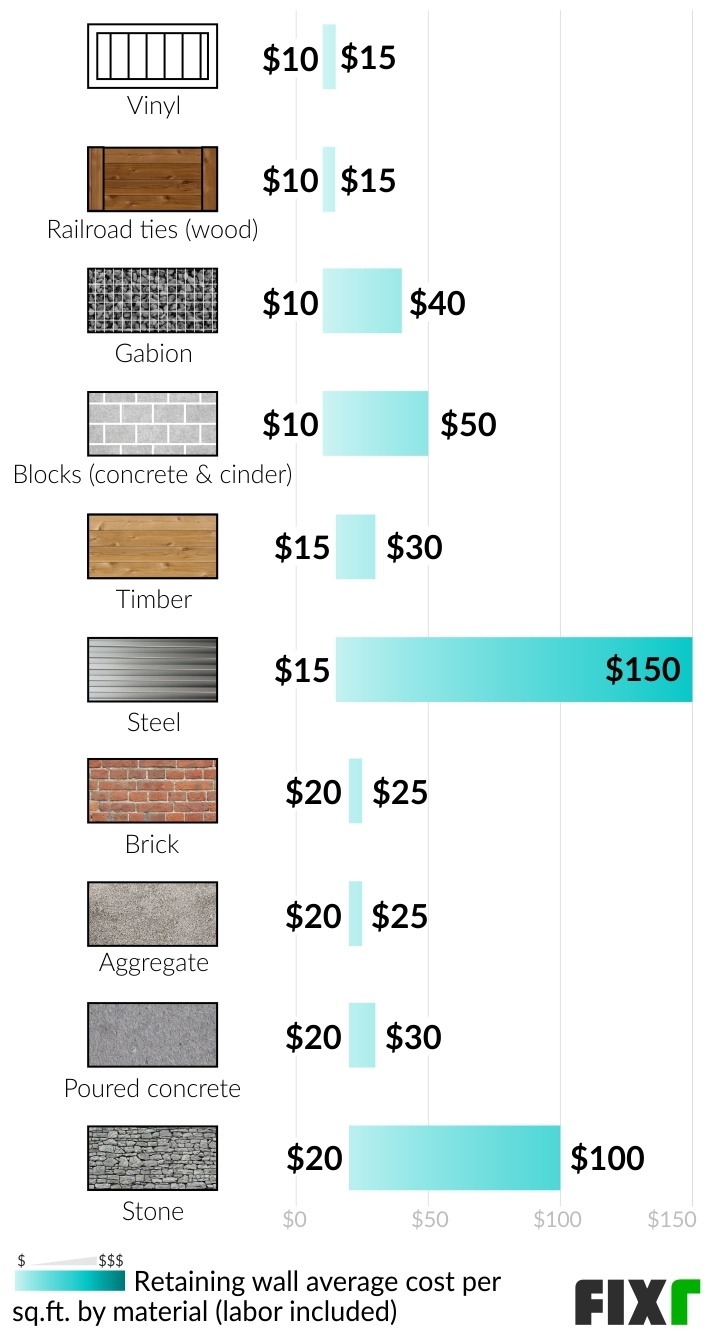

Hi, I have a retaining wall that runs along my driveway. It's ~30ft long and just under 2ft high. It was originally cinder blocks with. Keep in mind, however, that the average national cost for building a retaining wall is around $9, Dry stone walls are the cheapest followed by poured. Block retaining walls cost between $10 and $50 per bitcoinexchanges.site Cinder blocks are much cheaper, typically costing between $10 and $15, while concrete blocks cost. Stone walls can cost anywhere from $5-$ per square foot, depending on the type of stone you choose. Brick, wood, or railroad tie retaining walls are some of. Living in a sloped area has its disadvantages. Besides the many concerns that homeowners may have, there are many ways to avoid the complications that could. an Average size wall 70' long and ' high is just under $25,,. and a large 2-tiered wall 85' long ' high is about $50, Now while those prices are. Concrete retaining walls cost $10 to $ per square face foot (or the square feet of the face of the wall). You can choose from poured, split-face block, or. Many of the common types and sizes of retaining walls in Minnesota cost somewhere between $ per square foot. How Does the Material Affect Retaining Wall. In general, you can budget between $10 and $ per square foot for a new concrete retaining wall; commercial installations can go as high as $ per square. Hi, I have a retaining wall that runs along my driveway. It's ~30ft long and just under 2ft high. It was originally cinder blocks with. Keep in mind, however, that the average national cost for building a retaining wall is around $9, Dry stone walls are the cheapest followed by poured. Block retaining walls cost between $10 and $50 per bitcoinexchanges.site Cinder blocks are much cheaper, typically costing between $10 and $15, while concrete blocks cost. Stone walls can cost anywhere from $5-$ per square foot, depending on the type of stone you choose. Brick, wood, or railroad tie retaining walls are some of. Living in a sloped area has its disadvantages. Besides the many concerns that homeowners may have, there are many ways to avoid the complications that could. an Average size wall 70' long and ' high is just under $25,,. and a large 2-tiered wall 85' long ' high is about $50, Now while those prices are. Concrete retaining walls cost $10 to $ per square face foot (or the square feet of the face of the wall). You can choose from poured, split-face block, or. Many of the common types and sizes of retaining walls in Minnesota cost somewhere between $ per square foot. How Does the Material Affect Retaining Wall. In general, you can budget between $10 and $ per square foot for a new concrete retaining wall; commercial installations can go as high as $ per square.

Block retaining walls start at $ and can go up to $ per square foot, making them one of the most affordable to work with. Some prices vary according to. an Average size wall 70' long and ' high is just under $25,,. and a large 2-tiered wall 85' long ' high is about $50, Now while those prices are. Do-it-yourself materials cost about $$15 a square face foot. bitcoinexchanges.site provides a video[1] showing how to build a block wall, calling the project ". A basic retaining wall will cost about $30 to $60 per square foot. The price could go up to $60 to $85 per square foot, depending on the degree of difficulty. I need to add a retaining wall to my property. One resource I found had said an average cost would be $25 per sq ft. Wall blocks can hover between $10 to $15 per square foot, and wood can run from $15 up to $ Retaining walls can have many different purposes, which is. However, as a general guideline, retaining walls can range anywhere from $20 to $ per square foot, including materials and labor. This range. How much does it cost to build a retaining wall? Hiring a contractor to build a poured concrete retaining wall usually costs between $30 and $50 per square foot. The basic cost to Install a Block Retaining Wall is $ - $ per square foot in April , but can vary significantly with site conditions and. Lastly, consider the drainage and the need for additional support as important cost-impact factors that can raise the retaining wall prices per square foot from. Typically Allan Block walls have costed around $40 – $ per square foot of wall. Although that price range has seen some increase in the past few years due. Expect stone fence costs between $25 to $75 per square foot for a fieldstone retaining wall and $40 to $80 per hour of labor plus the cost of materials for a. Typical price per square foot is from 15$ to 60$. The cost of small retaining wall differs significantly from walls taller than 3 feet, because of the advanced. Fieldstone retaining walls cost $25 to $75 per square foot on average. However, the size, accessibility and regional cost factor into the wall's final price. RETAINING WALLS · OR $80 - $88 per SQ FT installed. · OR $ - $ per block installed. Plan on spending $$55 per face square foot. No idea what this actually means for your budget? Don't feel bad. Also, you might be reading this in the morning. Labor costs, averaging between $10 and $30 per square foot, and material expenses, ranging from $5 to $20 per square foot, are meticulously considered in our. Concrete Block or Poured Concrete Retaining Wall: These walls are more durable and long-lasting. Costs can vary from $20 to $60 per square foot. Retaining Wall Costs ; Materials, $10 to $30 per square foot ; Site prep, $2 per square foot ; Drainage, $ to $70 per linear foot ; Total Cost, $2,$10,

Stocks To Keep An Eye On

You'll have to keep one eye on your stock picks and another on changes in the marketplace. Momentum investing. Momentum investors ride the waves of market. These Are The Five Best Stocks To Buy And Watch Now · Netflix (NFLX) · Meta Platforms (META) · Freshpet (FRPT) · Broadcom (AVGO) · Sea ADR (SE). To invest with the odds in your favor, keep a close eye on your preferred stocks until they receive a Buy or Strong Buy rating (AI Score 7 to 10). The AI. Keeping an eye on the trading volume will also help you spot stocks that may be on the uptick. Management: A management team that is set on turning the company. How you can choose the best stocks to buy ; Cadence Design Systems · Technology · $ billion ; Coca-Cola · Consumer staples · $ billion ; Diamondback Energy. stop checking stocks. Investors and traders who are When you're a daytrader, you need to keep your eye on the price constantly. You'll have to keep one eye on your stock picks and another on changes in the marketplace. Momentum investing. Momentum investors ride the waves of market. Good Stocks To Buy Right Now? 2 Telecom Stocks To Watch. Telecom stocks to keep an eye on in the stock market today. 3 minute read. Stocks Drop as Growth Concerns Resurface. September 6, Nathan One last interesting development to keep an eye on is the strengthening of the yen. You'll have to keep one eye on your stock picks and another on changes in the marketplace. Momentum investing. Momentum investors ride the waves of market. These Are The Five Best Stocks To Buy And Watch Now · Netflix (NFLX) · Meta Platforms (META) · Freshpet (FRPT) · Broadcom (AVGO) · Sea ADR (SE). To invest with the odds in your favor, keep a close eye on your preferred stocks until they receive a Buy or Strong Buy rating (AI Score 7 to 10). The AI. Keeping an eye on the trading volume will also help you spot stocks that may be on the uptick. Management: A management team that is set on turning the company. How you can choose the best stocks to buy ; Cadence Design Systems · Technology · $ billion ; Coca-Cola · Consumer staples · $ billion ; Diamondback Energy. stop checking stocks. Investors and traders who are When you're a daytrader, you need to keep your eye on the price constantly. You'll have to keep one eye on your stock picks and another on changes in the marketplace. Momentum investing. Momentum investors ride the waves of market. Good Stocks To Buy Right Now? 2 Telecom Stocks To Watch. Telecom stocks to keep an eye on in the stock market today. 3 minute read. Stocks Drop as Growth Concerns Resurface. September 6, Nathan One last interesting development to keep an eye on is the strengthening of the yen.

“Growth stocks Take advantage of day-to-day opportunities to build your finances: Pay your credit-card debt on time and in full, keep your eye. Get latest Stocks In News India, Stocks In News, Latest Stocks In The News, Stocks In News Today. maintaining an 'Overweight' rating and a target price of Rs. Best S&P stocks as of September ; General Electric (GE), % ; Targa Resources (TRGP), % ; Constellation Energy (CEG), % ; Eli Lilly (LLY), %. Top blue chips stocks of Indian stock market are- Reliance, HDFC bank, Infosys, tcs,sbi, hul etc. Here are the stocks to keep an eye for in the trade today. #NDTVProfitStocks Read: bitcoinexchanges.site To invest with the odds in your favor, keep a close eye on your preferred stocks until they receive a Buy or Strong Buy rating (AI Score 7 to 10). The AI. Semiconductor giant Nvidia reports earnings next week, and all eyes are on the stock as the bellwether for the AI-fuelled surge in tech stocks. Nvidia CEO. Western Digital, HP Inc., Hewlett Packard Enterprise, and more inexpensive tech stocks to keep an eye on. 4 min read. Go to article · These 5 Retail Stocks Have. Stocks. To invest in a listed company, you can buy shares Shareholders should keep an eye on the company's performance, prospects and the way it is run. But stocks aren't just the only thing to consider. You can also invest in Keep a Watchful Eye on Commissions. If you are not the trading type. Here are the stocks to keep an eye for in the trade today. #NDTVProfitStocks Read: bitcoinexchanges.site Already have a J.P. Morgan account? Keep an eye on your investments and review your portfolio to help you reach your goals. Stock Recommendations - Get all the Stocks Recommendations & Expert Views on Indian Stocks Ensure security, prevent and detect fraud, and fix errors Keeping an eye on the share structure and other fundamental factors mentioned above will help investors find winners. Article Sources. Easier regulation of the sector could raise the market's expectations for bank profits and help boost bank stocks. Considering this, $Wells Fargo & Co (bitcoinexchanges.site)$. - Or the people who are just trying stock market and have bought 1 or 2 stocks. - Or for those who just keep an eye on daily stock price and keep track of. If you're an E*TRADE client, you have access to a wide range of listed and delisted penny stocks. Benzinga can also help you keep an eye on premarket movers. Stocks finish higher: Equity markets closed higher on Monday as stocks rebounded following a risk-off week. The S&P declined by more than 4% last week. Based on the above analysis we recommend buying ONGC and the CMP of with a stop loss of for the target of Disclaimer: The views and. Stocks To Watch | Ready, set, trade! Keep an eye on these stocks as they set the market abuzz #StockMarket.

Best Monthly Cd Rates

CERTIFICATE OF DEPOSIT (CD) · Smart CD savings and a great rate? You got it. For a limited time, lock in a promotional rate of % annual percentage yield (APY). written by Ken Tumin ; Kings Peak Credit Union. 12 Month Share Certificate · % ; Hudson Valley Federal Credit Union. 12 Month Flex CD · % ; Central. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. Find the best 6-month CD rates for your savings goals. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. Bankrate's picks for the top 9-month CD rates · Synchrony Bank · America First Credit Union · CIBC Bank USA · EverBank · Ally Bank · Marcus by Goldman Sachs. According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January Meanwhile, the. The highest 9-month CD rate today is % from Discover Bank. Best 1-year CD rates. The highest 1-year CD rate today is % from Merchants Bank of Indiana. CERTIFICATE OF DEPOSIT (CD) · Smart CD savings and a great rate? You got it. For a limited time, lock in a promotional rate of % annual percentage yield (APY). written by Ken Tumin ; Kings Peak Credit Union. 12 Month Share Certificate · % ; Hudson Valley Federal Credit Union. 12 Month Flex CD · % ; Central. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. Find the best 6-month CD rates for your savings goals. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. Bankrate's picks for the top 9-month CD rates · Synchrony Bank · America First Credit Union · CIBC Bank USA · EverBank · Ally Bank · Marcus by Goldman Sachs. According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January Meanwhile, the. The highest 9-month CD rate today is % from Discover Bank. Best 1-year CD rates. The highest 1-year CD rate today is % from Merchants Bank of Indiana.

Current 6-month CD rates · America First Credit Union — % APY · Quontic Bank — % APY · Bask Bank — % APY · Bank5 Connect — % APY · First Internet. Who has the highest CD rates today? ; Forbright Bank CD, %, 9-Month ; Nationwide Bank CD, %, 1-Year ; Charles Schwab Bank CD, %, 2-Year ; CFG Bank CD. Certificates of deposit. ; 6-month CD · ; month CD · ; month CD · Our top picks for banks with the best CDs ; Barclays · % to %, 6 months to 5 years ; Capital One · % to 5%, 6 months to 5 years ; Marcus · % to %. Bankrate's picks for the top 1-month CD rates · SchoolsFirst Federal Credit Union: % APY; $20, minimum deposit to earn APY · Huntington National Bank. Best 3-Month CDs (2–4 months included) · Merchants Bank of Indiana, % ; Best 6-Month CDs(5–9 months included) · INOVA Federal Credit Union · % ; Best 1-Year. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Our Highest CD Rate ; 12 MONTHS. % ; 24 MONTHS. % ; 36 MONTHS. % ; 60 MONTHS. %. Certificates of deposit. ; 6-month CD · ; month CD · ; month CD · written by Ken Tumin ; Kings Peak Credit Union. 12 Month Share Certificate · % ; Hudson Valley Federal Credit Union. 12 Month Flex CD · % ; Central. Discover the best 6-month CD rates. A 6-month CD offers secure competitive returns for a span of 6 months. The top 6-month CDs pay up to % APY. Today's CD Special Rates ; 4 month · % · % ; 7 month · % · % ; 11 month · % · %. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. What types of CDs does TowneBank offer? · Traditional CD · Month Add-on CD · Jumbo CD. Best CD Account Interest Rates As of Aug. 19, , the national average rate for a month CD was %, according to the FDIC. The national average rate. The interest rate for the 6-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does. Our top picks for banks with the best CDs ; Barclays · % to %, 6 months to 5 years ; Capital One · % to 5%, 6 months to 5 years ; Marcus · % to %. Best 3-Month CDs (2–4 months included) · Merchants Bank of Indiana, % ; Best 6-Month CDs(5–9 months included) · INOVA Federal Credit Union · % ; Best 1-Year. The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the last 15 years. But as. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %.

Va Mortgage Rates Washington State

The current average year fixed mortgage rate in Washington increased 8 basis points from % to %. Washington mortgage rates today are 2 basis points. Veterans is a downpayment assistance, second mortgage loan program with a % interest rate and payments deferred for up to 30 years for Washington State. Current VA Mortgage Rates ; Year Fixed VA Purchase, %, % ; Year Fixed VA Purchase, %, % ; Year Fixed VA Purchase, %, % ; rates3-year ARM ratesFHA mortgage ratesVA mortgage ratesBest mortgage lenders Purchase loans are not available in all states. Doesn't offer home equity. In August , year fixed-rate VA loans have the lowest average APR for year fixed-rate mortgages at %. Knowing your options can help you decide on a. Find mortgage rates by state. Enter a state. Current Location. Show rates Check Mark Icon Adjustable-rate; Check Mark Icon FHA; Check Mark Icon VA; Check Mark. Compare Washington mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Who has the lowest VA rates? · Freedom Mortgage Company · Quicken Loans · Veterans United · PennyMac · Lakeview Loan Servicing. The current average year fixed VA mortgage rate remained stable at % on Wednesday, Zillow announced. The year fixed VA mortgage rate on August The current average year fixed mortgage rate in Washington increased 8 basis points from % to %. Washington mortgage rates today are 2 basis points. Veterans is a downpayment assistance, second mortgage loan program with a % interest rate and payments deferred for up to 30 years for Washington State. Current VA Mortgage Rates ; Year Fixed VA Purchase, %, % ; Year Fixed VA Purchase, %, % ; Year Fixed VA Purchase, %, % ; rates3-year ARM ratesFHA mortgage ratesVA mortgage ratesBest mortgage lenders Purchase loans are not available in all states. Doesn't offer home equity. In August , year fixed-rate VA loans have the lowest average APR for year fixed-rate mortgages at %. Knowing your options can help you decide on a. Find mortgage rates by state. Enter a state. Current Location. Show rates Check Mark Icon Adjustable-rate; Check Mark Icon FHA; Check Mark Icon VA; Check Mark. Compare Washington mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Who has the lowest VA rates? · Freedom Mortgage Company · Quicken Loans · Veterans United · PennyMac · Lakeview Loan Servicing. The current average year fixed VA mortgage rate remained stable at % on Wednesday, Zillow announced. The year fixed VA mortgage rate on August

The average VA loan interest rate as of August 21, is % for a year fixed mortgage. What is a VA Loan? A VA loan, also known as a Veterans Affairs. Rates as of Aug 29, ET. The interest rate above shows the option of purchasing discount points to lower a loan's interest rate and monthly payment. One. No down payment required: For many servicemembers, this is the most attractive feature of a VA loan. · Lower interest rates: VA loans typically offer interest. Today's competitive mortgage rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · Today's mortgage rates in Washington are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. VA Mortgage Rates ; April , %, %, % ; March , %, %, %. No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage Insurance (PMI) · The VA home loan is a lifetime. View current rates for a variety of home loans, including FHA loans, VA loans, other fixed-rate options and adjustable-rate mortgages. A VA home loan is a benefit provided by the Department of Veteran Affairs (VA) to help service members and veterans build, purchase, or refinance a home. Compare Current VA Mortgage Rates · At a 5% interest rate. $1, in monthly payments (excluding taxes, insurance and HOA fees) · VA-backed purchase loan: The. Looking for home mortgage rates in Washington? View loan interest rates from local banks, WA credit unions and brokers. Using our free interactive tool, compare today's rates in Washington across various loan types and mortgage lenders. Find the loan that fits your needs. Today's VA Home Loan Rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. an approved lender through the United States Department of Veterans Affairs. NMLS # Fixed Rate Mortgages · Adjustable-Rate Mortgages · Construction. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. The average rate for a 5/1 ARM in Washington is % (Zillow, Jan. ). Washington Mortgage Resources. Need assistance buying a house in the Evergreen State? The loan limit goes as high as $1,, for a four-unit house. It is important to note that loan limits do not indicate how much money a borrower can qualify. Just got quoted % on a VA loan. First time home buyer with credit. Ended up going conventional for several reasons, but the rate was. Mortgage rates continue to hover near the lowest levels of the year. The year fixed rate currently sits at %, % APR with points. Sammamish Mortgage can give you a personalized quote for current mortgage rates in Washington State rate mortgages, conforming loans, FHA loans, and VA loans.

A Wash Sale

Wash sale regulations disallow an investor who holds an unrealized loss from accelerating a tax deduction into the current tax year, unless the investor is out. Find out how wash sales affect your trades and how Schwab's trading platforms display wash sales and disallowed losses. What is a wash sale? If a stock you own. The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a "substantially identical" investment 30 days before or. Sec. Loss from wash sales of stock or securities · Internal Revenue Code of · SUBTITLE A -- INCOME TAXES · Chapter 1 -- Normal Taxes and Surtaxes. General Rule In general you have a wash sale if you sell a specified asset at a loss, and buy substantially identical securities within 30 days before or. After incurring a loss on long or short shares, any option positions resulting in shares from an assignment or (auto) exercise within 30 days can incur a wash. A wash sale is the sale of securities at a loss and the acquisition of same (substantially identical) securities within 30 days of sale date (before or after). The wash sale rule prevents investors from claiming the tax benefits from stock losses if they have also purchased the same stock any time during a window. Generally, a wash sale is what occurs when you sell securities at a loss and buy the same shares within 30 days before or after the sale date. Wash sale regulations disallow an investor who holds an unrealized loss from accelerating a tax deduction into the current tax year, unless the investor is out. Find out how wash sales affect your trades and how Schwab's trading platforms display wash sales and disallowed losses. What is a wash sale? If a stock you own. The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a "substantially identical" investment 30 days before or. Sec. Loss from wash sales of stock or securities · Internal Revenue Code of · SUBTITLE A -- INCOME TAXES · Chapter 1 -- Normal Taxes and Surtaxes. General Rule In general you have a wash sale if you sell a specified asset at a loss, and buy substantially identical securities within 30 days before or. After incurring a loss on long or short shares, any option positions resulting in shares from an assignment or (auto) exercise within 30 days can incur a wash. A wash sale is the sale of securities at a loss and the acquisition of same (substantially identical) securities within 30 days of sale date (before or after). The wash sale rule prevents investors from claiming the tax benefits from stock losses if they have also purchased the same stock any time during a window. Generally, a wash sale is what occurs when you sell securities at a loss and buy the same shares within 30 days before or after the sale date.

Wash sale: A sale of stock or securities at a loss within 30 days before or after you buy or acquire in a fully taxable trade, or acquire a contract or option. The bottom line. The wash-sale rule prevents investors from claiming investment losses if they purchase a substantially identical security within 30 days before. Primary tabs. A wash sale is defined as the sale of an asset, such as stocks or bonds, at a loss, followed by the repurchase of the same or substantially. Enter a wash sale · Go to the. B&D. screen or the. Broker. screen, both located in the. Income · From the. B&D. screen, open the. Schedule for detail. statement. A wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Buy substantially identical securities. After reading the ruling it is clear that one of the requirements for it to be deemed a wash sale is to claim the capital loss after selling and immediately. If you trigger a wash sale, the amount of loss that is not deductible will be added to the cost of the newly purchased, substantially identical stock. This. What Is the Wash Sale Rule? The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same. § Loss from wash sales of stock or securities · (a) Disallowance of loss deduction · (b) Stock acquired less than stock sold · (c) Stock acquired not less. A wash sale occurs when you sell a stock for a loss and then buy it again in the 61 day period 30 days before and 30 days after the sale. You. The wash sale rule states that if you buy or acquire a substantially identical stock within 30 days before or after you sold the declining stock at a loss, you. What is the wash sale rule? The wash sale rule prohibits taxpayers from claiming a loss on the sale or other disposition of a stock or securities if, within the. If you close your position, say mid-December , and repurchase the stock in January before the end of the day window, you've technically made a wash. To ensure that investors don't get a tax break and then instantly buy back their original investment, the government has what's known as the “wash sale” rule. After incurring a loss on long or short shares, any option positions resulting in shares from an assignment or (auto) exercise within 30 days can incur a wash. Overview. A wash sale is a transaction in which the owner of stock or securities realizes a loss on their sale or other disposition, and reacquires. - Entering a Wash Sale How do I report a wash sale in an individual return? Open the screen (the Income tab). Enter all information as. Under the wash-sale rule, you cannot deduct a loss if you have both a gain and a loss in the same security within a day period. (That's calendar days, not. Key takeaways. 1. Understanding the wash-sale rule can help you save on taxes. 2. If you sell a stock for tax-loss harvesting purposes, you can't rebuy the same. If you have a loss from a wash sale, you cannot deduct it on your return. Additionally, a gain on a wash sale is taxable. Forms and Schedule D will be.

How To Consolidate Credit Debt

This guide will help you understand what debt consolidation is, how various options to consolidate debt work, and how to decide if it's right for you. Debt consolidation is when you combine several smaller debts or loans into a single loan with one monthly payment. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs). Debt consolidation, in Canada, is the process of combining multiple debts into a single one. Juggling multiple debts, such as payday loans, unsecured lines of. Consolidate debt onto one credit card. You can transfer every one of your credit card accounts to one main card. You'll want to find a card with a favorable. A debt consolidation loan may help you pay off higher-interest debt by combining multiple balances into one payment. Get up to $ with Discover. What to know first: Debt consolidation loans allow borrowers to combine several high-interest debt into a new loan. The best ones offer low rates. Transfer high-interest credit card balances to a personal loan from $5K-$K to reduce your monthly payments so you can save money. What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help. This guide will help you understand what debt consolidation is, how various options to consolidate debt work, and how to decide if it's right for you. Debt consolidation is when you combine several smaller debts or loans into a single loan with one monthly payment. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs). Debt consolidation, in Canada, is the process of combining multiple debts into a single one. Juggling multiple debts, such as payday loans, unsecured lines of. Consolidate debt onto one credit card. You can transfer every one of your credit card accounts to one main card. You'll want to find a card with a favorable. A debt consolidation loan may help you pay off higher-interest debt by combining multiple balances into one payment. Get up to $ with Discover. What to know first: Debt consolidation loans allow borrowers to combine several high-interest debt into a new loan. The best ones offer low rates. Transfer high-interest credit card balances to a personal loan from $5K-$K to reduce your monthly payments so you can save money. What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help.

A personal loan from a reputable credit union or bank is the most popular way to consolidate significant debt—and for good reason. Typically, a personal loan. With over 10 million people helped since , Consolidated Credit can help you find debt relief through credit counseling and debt consolidation. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan. Consolidate your credit card debt with ease · Check your rate in 5 minutes. · Get funded in as fast as 1 business day.² · Combine multiple bills into 1 fixed. What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans. Whichever way you decide to consolidate your debt, 1st United can help you make it happen. We also have plenty of tools to help you figure out payments. Debt consolidation means taking out a single loan that can be used to pay off your other debts, such as credit cards, lines of credit, student loans and car. Debt consolidation is when you bring your outstanding balances to a single bill and it can be a useful way to manage your debt. Offered by financial institutions, a debt consolidation loan combines debts into a new loan with a single interest rate. Personal loans and unsecured lines of. A debt consolidation loan is a loan that allows you to repay many other debts. For example, if you have three credit cards, you may be able to get a debt. Debt Consolidation: Debt consolidation combines multiple debts into a new loan with a single monthly payment. You may be able to obtain a lower rate, lower. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. Debt consolidation is when you combine all your debt into a single new loan that comes with just one monthly payment. These types of loans are useful for those. What options exist to consolidate credit card debt? Free expert advice on what to do and managed debt solutions from StepChange, the leading UK debt. Debt consolidation is ideal when you are able to receive an interest rate that's lower than the rates you're paying for your current debts. Many lenders allow. Transfer high-interest credit card balances to a personal loan from $5K-$K to reduce your monthly payments so you can save money. Consolidating your debt into one payment may help you pay it down faster and give you more control of your money. Discover your options. As the Government of Canada's Office of Consumer Affairs (OCA) explains, “debt consolidation loan is a loan (usually from a bank) that lets you repay your debts. Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated loan. Debt consolidation is pretty much what it sounds like: It's the practice of consolidating several debts into one debt. It's typically done by taking out a loan.

1 2 3 4 5 6